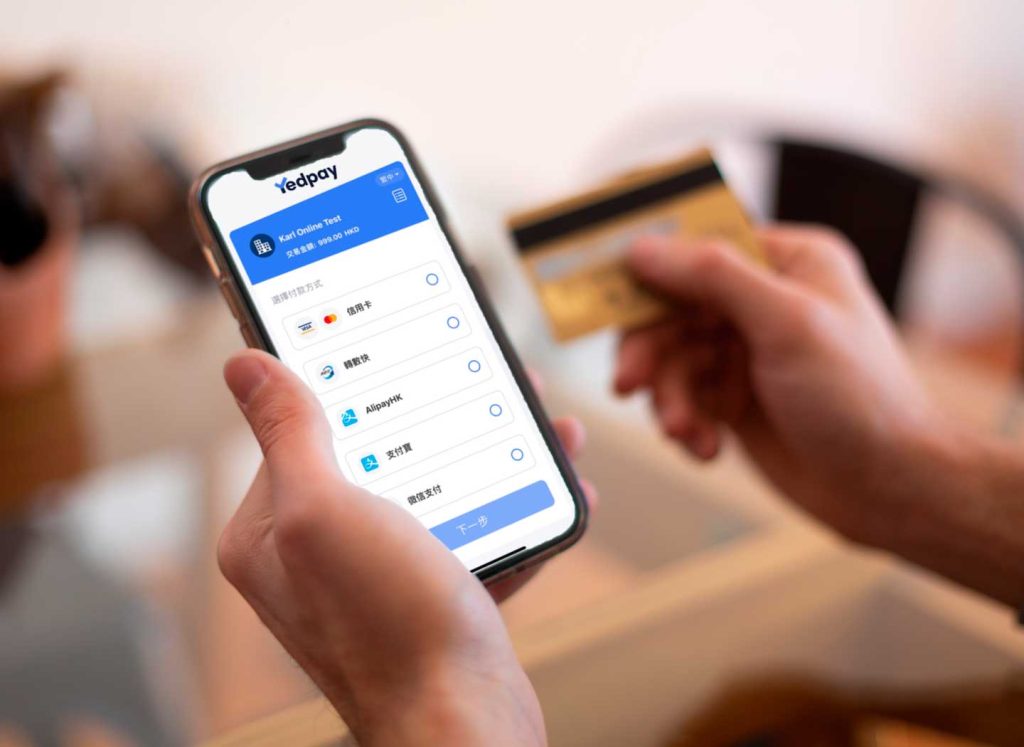

All-in-one payment platform for businesses, ISVs, and ISOs looking to provide their customers with seamless payment terminals or online payment services

In-store, mPOS, unattended, QR, or online payments – experience fast hosting, advanced security, and dedicated support.

Take a look at the payment solutions supported in Yedpay

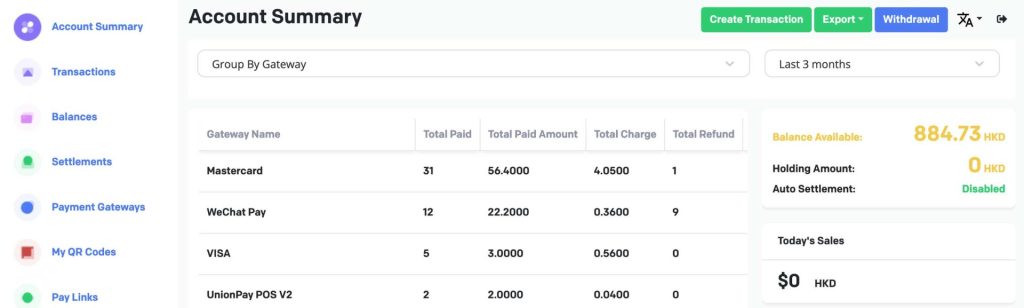

Yedpay Merchant Portal is for you to manage payments

Yedpay offers scalable online tools and APIs for managing sales data, helping you build the best possible product for your business

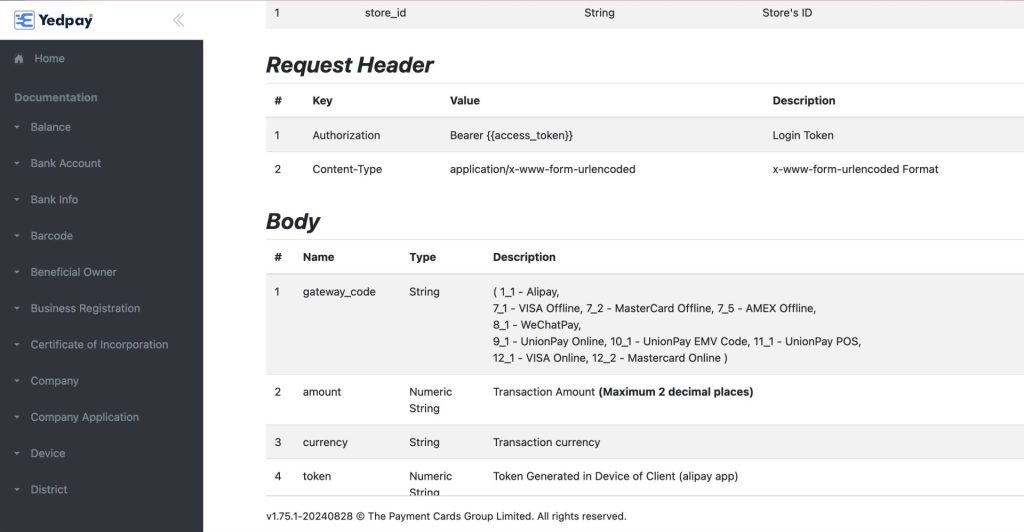

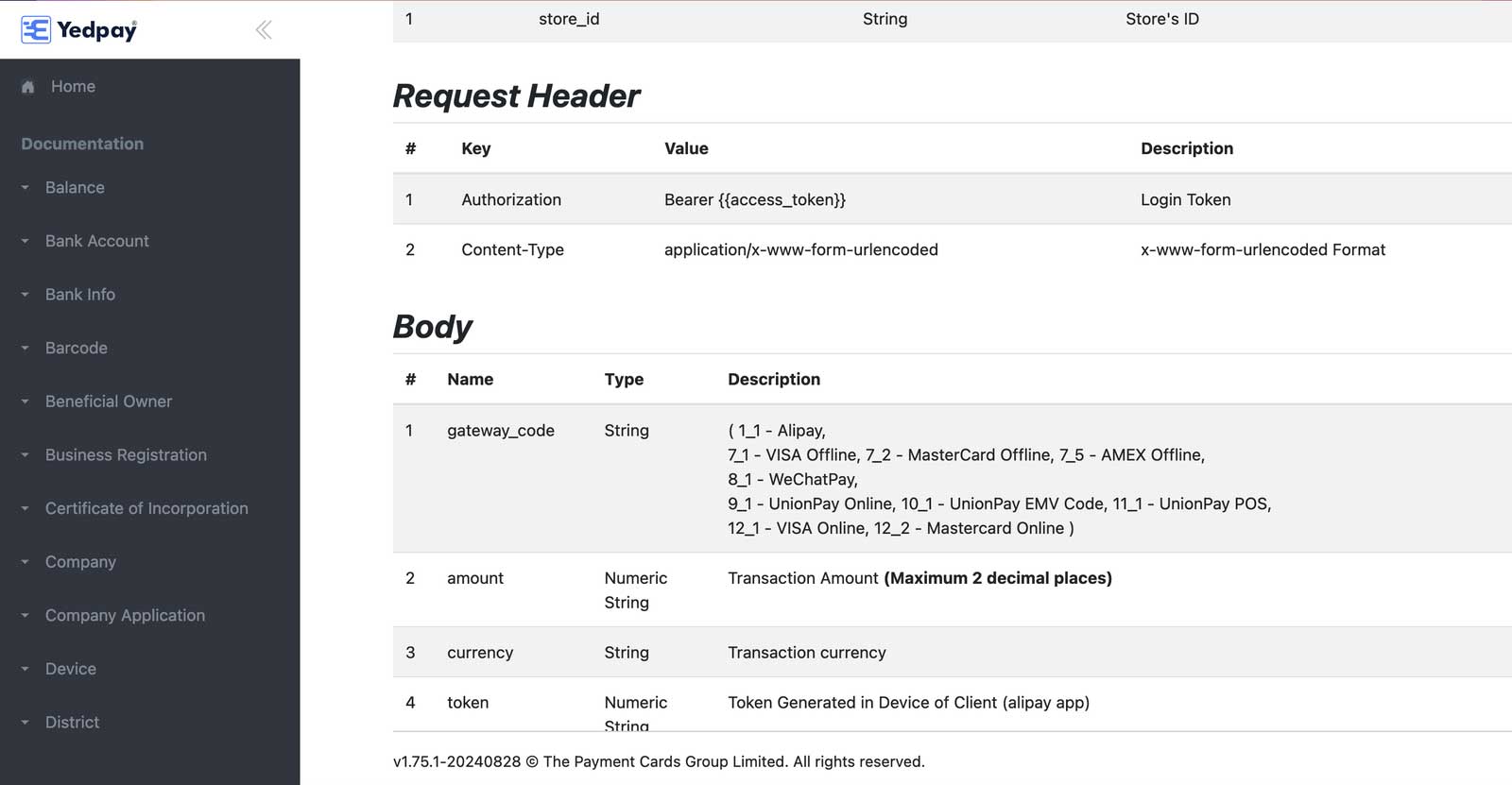

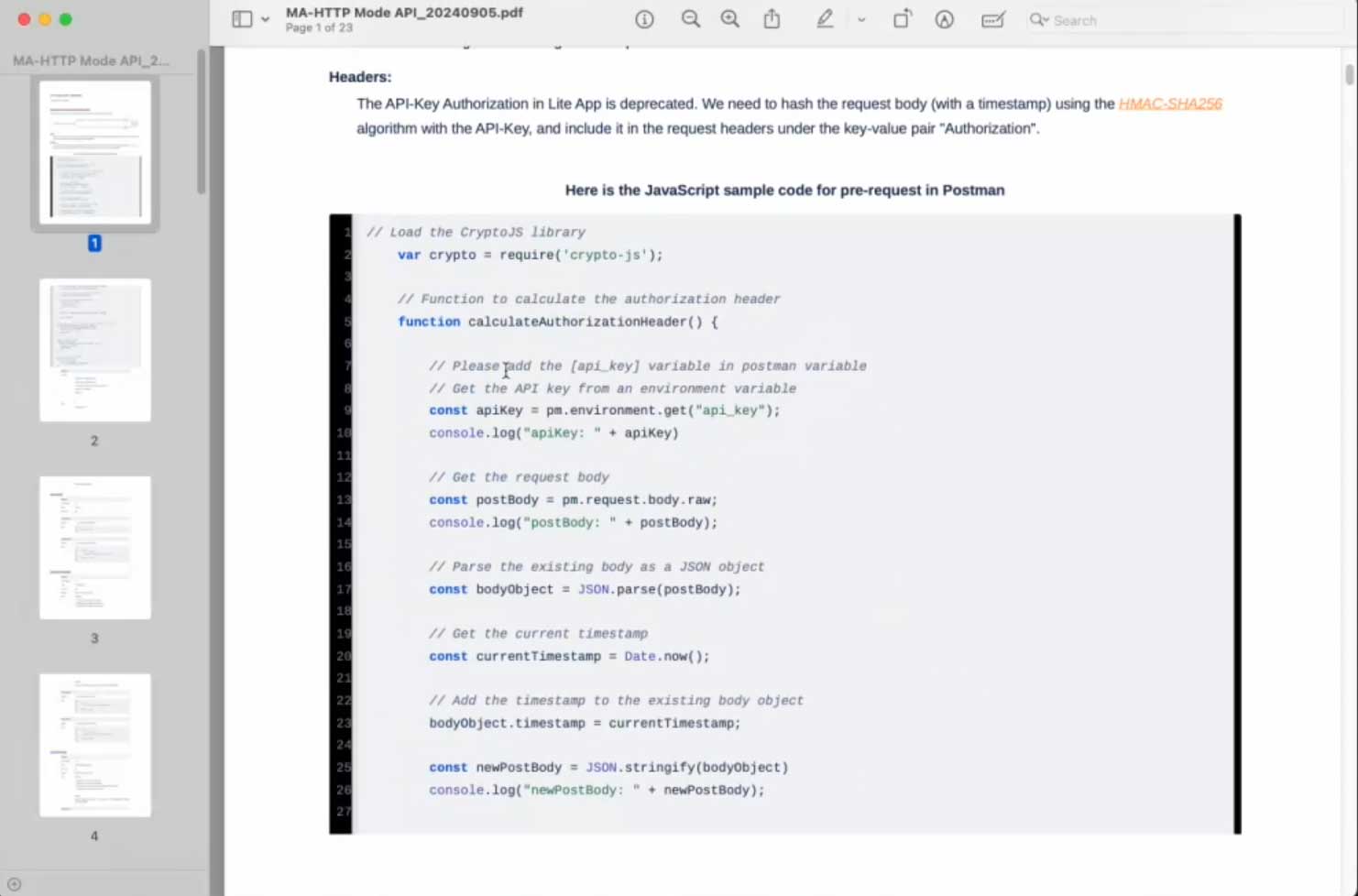

Built by developers for developing APIs

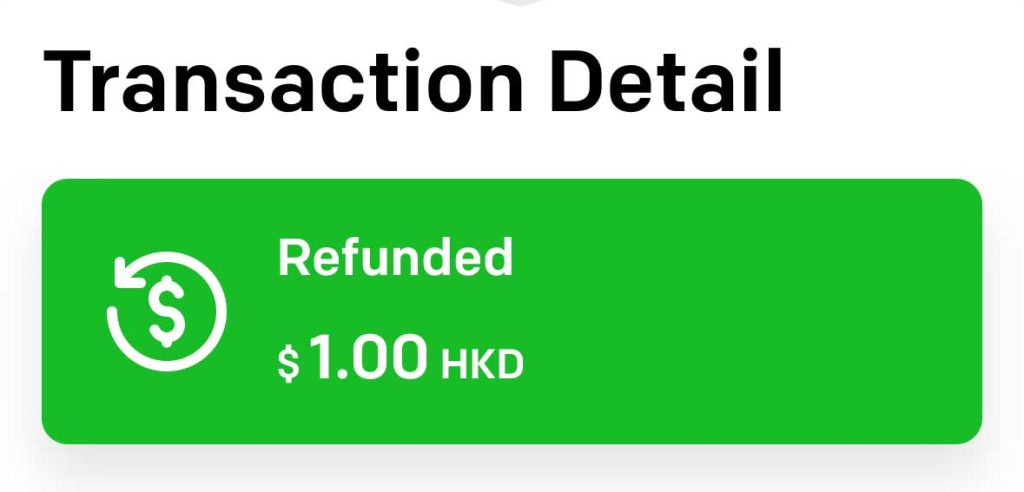

Instant manage partial or full on merchant portal.

Create open or fix amount payment link and Share your link effortlessly

Create user profiles to different job functions, ensuring that access aligns with organizational needs.

As a principal member of major card schemes with direct processing capabilities, our platform manages transactions autonomously, ensuring fast, secure, and cost-effective payment services by interfacing directly with top card networks.

Compliance to PCI DSS Level 1

PCI DSS COTS

PCI DSS CPoC

EMV Level 2 and Level 3 Certification

Our Cloud payment platform complies with ISO 27001 standards, ensuring that your data is managed securely and adheres to the highest international information security protocols.

Join our premium product lauch to unlock the power of payment data!

Launch your payment business this week

For common questions about Yedpay payment terminals

Sandbox is available upon request for you to quick try and start

Resources to get started and scale up quickly.

Keep up to date with Yedpay’s news and events by subscribing to our newsletter. Don’t miss them out and subscribing is free.

By subscribing to our newsletter, you agree to our terms and privacy policy and receive emails from us.